Brex Reviews & Product Details

Brex is a financial services platform built especially for startups and small businesses. The software allows users access to expense management tools and even the use of corporate credit card and rewards programs so businesses can manage finances more efficiently and save money through rewards and discounts on business expenses.

| Capabilities |

|

|---|---|

| Segment |

|

| Deployment | Cloud / SaaS / Web-Based, Mobile Android, Mobile iPad, Mobile iPhone |

| Training | Documentation |

| Languages | English |

I love the simplicity of the platform. It's clean, easy to use, and functional for multiple use cases such as online purchases, digital card applications, and physical card applications. The receipt tracking and memo input fields have a great UX. All around a terrific suite of features.

The only improvement I would suggest is to limit the number of 2-factor authentication requests when signing on via laptop.

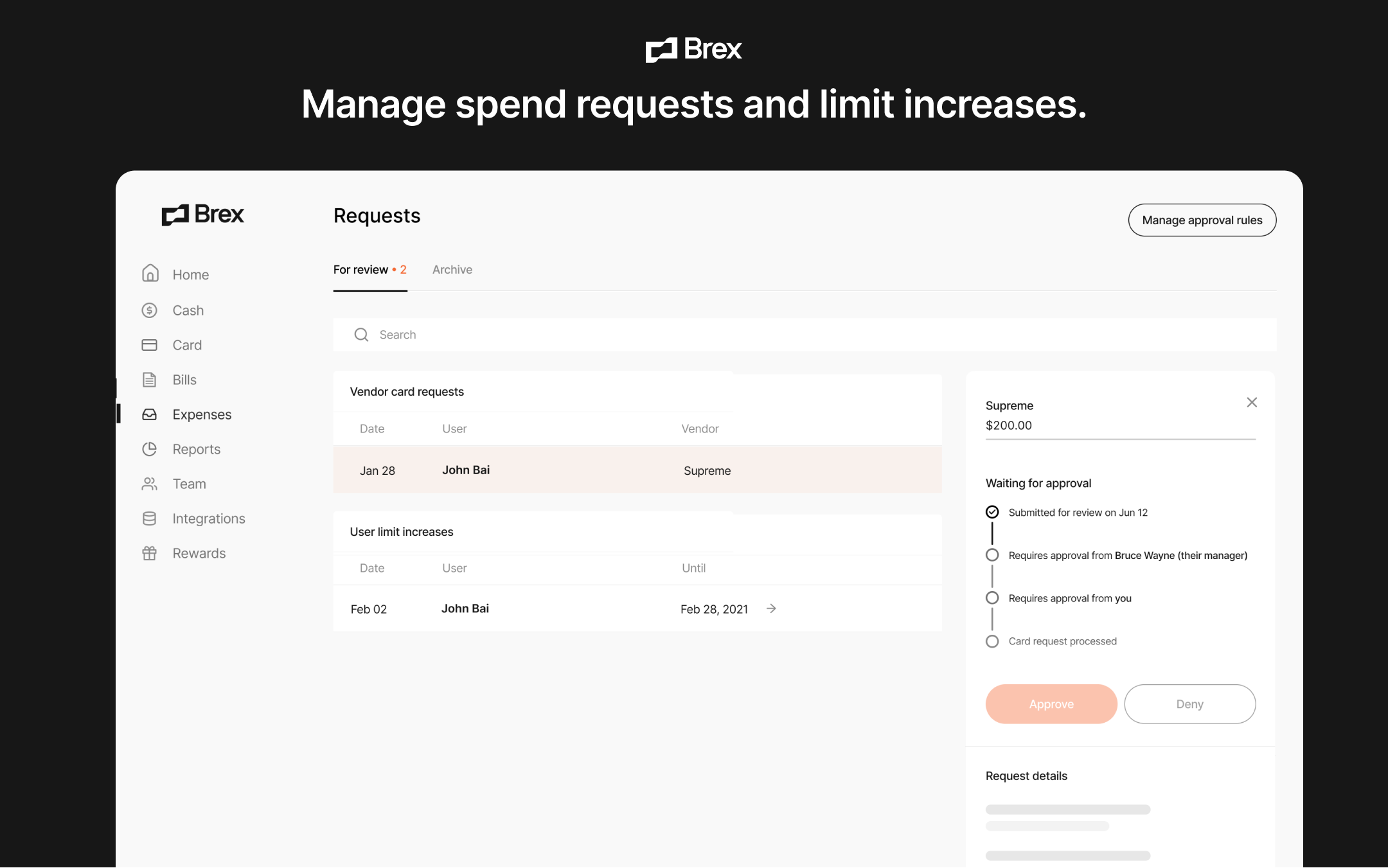

I work in marketing and produce events for our company. Our controller and raise my limit in an instant if I need more resources while onsite. Solving problems quickly is crucial for program success, and cash flow isn't an issue with Brex.

The online access is so easy to use, great for tracking expenses and uploading receipts and the online support is always quick and easy to use.

I often use the search functions to find certain charges and it works very well by name, but would be nice if it also worked by searching for numerical values/amounts.

Brex is easier to use and track than many other cards.

Brex listened to feedback to improve incoming wires from the UK and Europe. They moved at a faster pace to partner with other banks and made it happen.

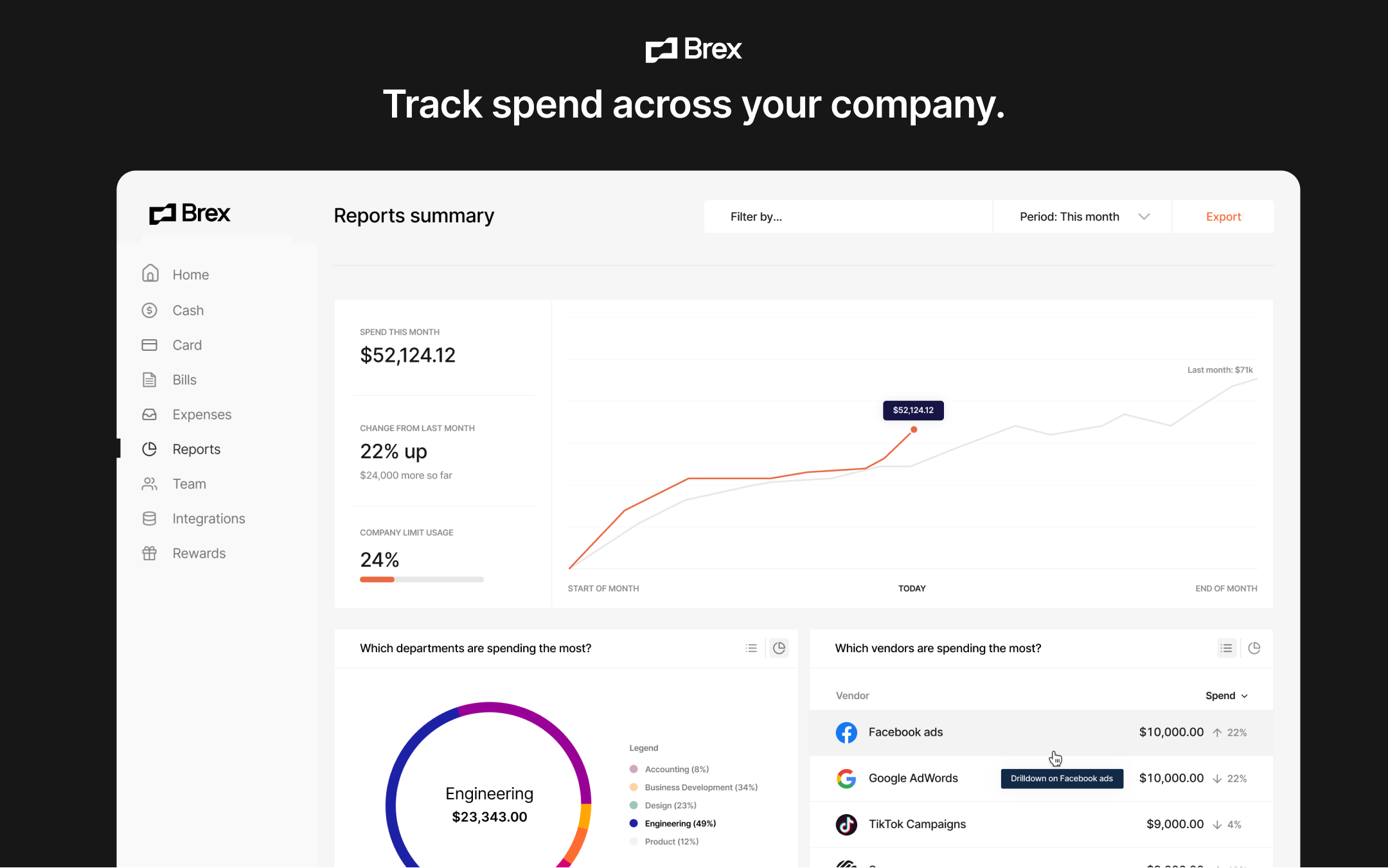

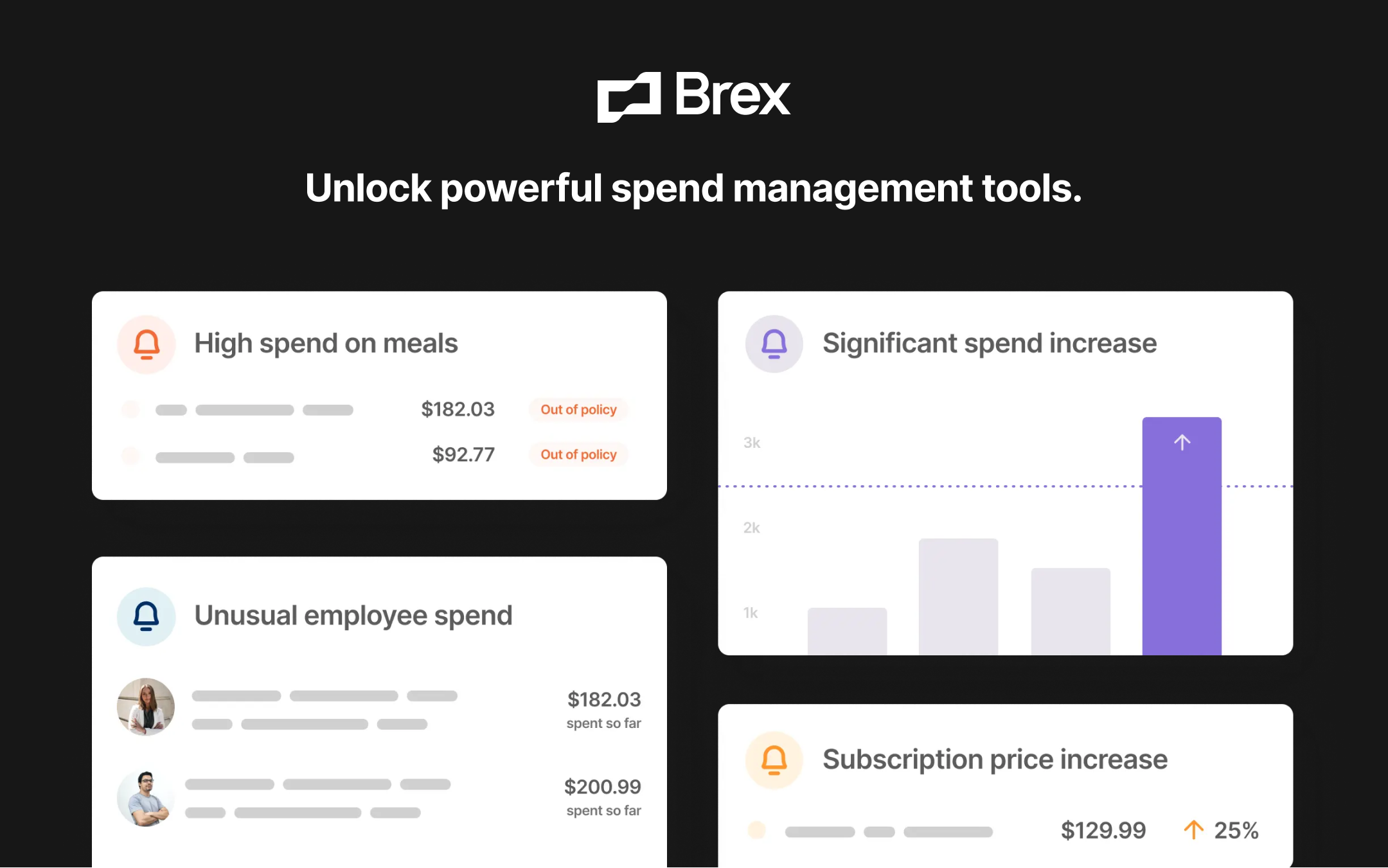

Brex could include an end-of-week summary or insights of money in, money out, charts, rewards, etc.

Business Checking, Wires, ACH, Credit Card, Virtual Credit Cards,

Easy sign up process, nice benefits and sign on bonus, easy to use mobile app and website that enables you to track expenses and attach receipts. Easy wire transfers. Reasonable credit limit from the start.

Not much but wish they had a savings option that paid decent interest, also as an android user I feel I get asked to log back in and two or three factor authenticate a lot which is a barrier.

Easy to use business banking. Travel points paid for our SXSW hotel. Easy expense tracking. Credit card, points and travel. Savings and payroll. Receipt tracling

I think BREX is very intuitive and allow users to really understand the way they spend money.

Nothing so far. I think I have the right info for my purpose.

I like it can integrate with Quickbooks Online so it eases my job big time

User interface feature. Text message confirmation of purchases.

Sometimes not accepted at certain gas stations

Sometimes not accepted at certain gas stations. Cash back.

Virtual card and emailing receipts to attach to transactions

That the virtual card isn't the default card shown when you log in

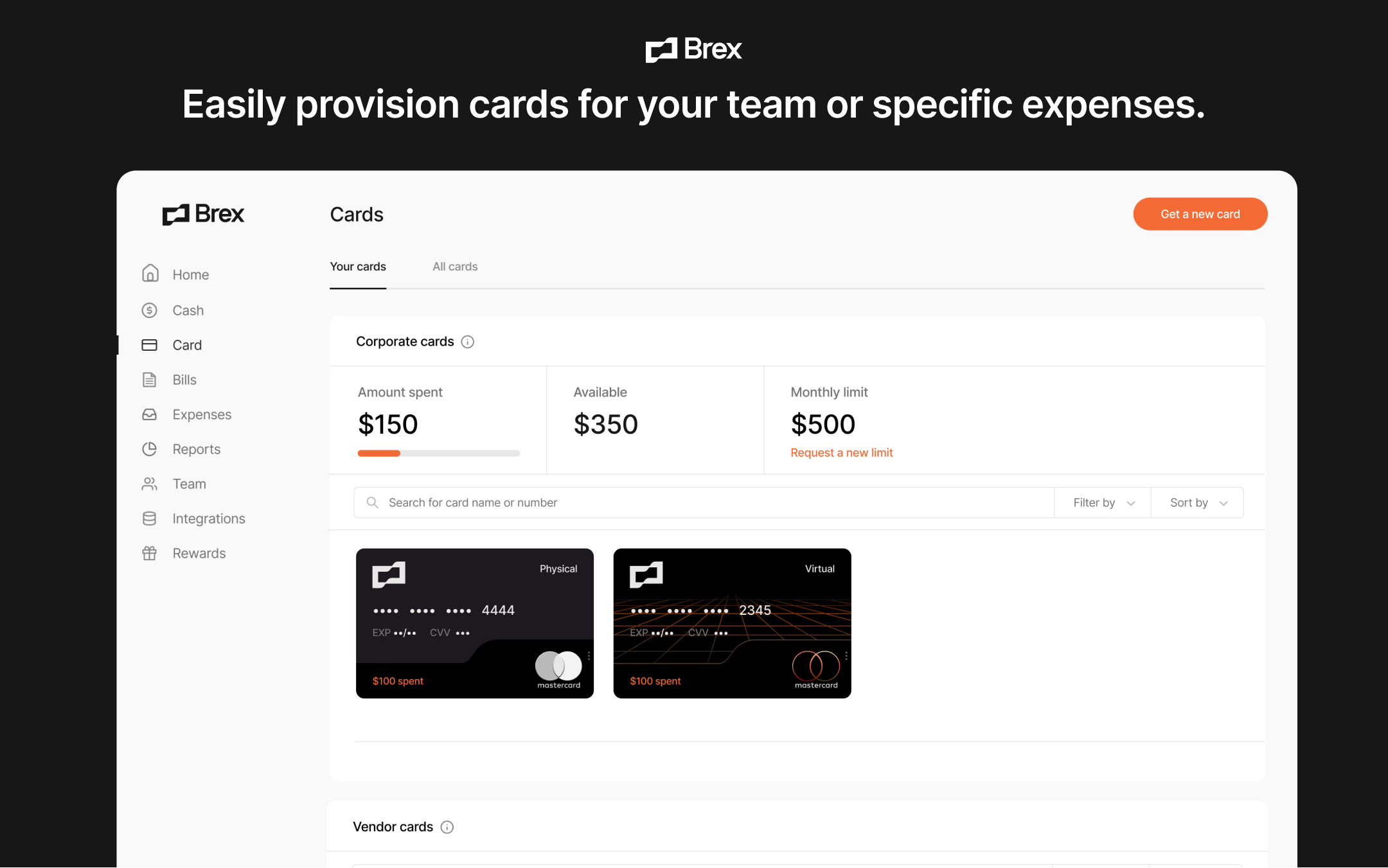

Most people are making online purchases so not having to get them a physical card is really nice. Also not having to approve expenses because they have a card.

I like the text messages I get after making a purchase on my card, as well as the help/support resources. I like that I can add users (I'm an Admin) and order cards for them, also assign a Manager and user limit.

Only complaint is that I was confused on was my getting 3 cards. I didn't understand at first why I had both a physical and virtual card - now I understand but some initial explanation would have been helpful. I lied, one more thing - I was. a little confused when trying to add a user and card - I saw that we were maxed out on the number of cards, but that turned out to be info for my own card, not our limit as a company. A quick chat with Support helped to clarify, but at first I thought we'd have to cancel some cards or upgrade a plan somehow.

I believe our company moved to Brex for the savings. I like how easy the site is to use. We're able to easily track usage and see what our team members are buying.

Brex removes all friction we get with traditional banks. The easy access to credit cards and the expense feature are really useful for small and medium-sized businesses. Customer service is also great!

We should have the option to create a monthly card or not when we create a new user. For now, it automatically creates one, which can lead to some mistakes if you don't review the user enrollment.

Brex allows small businesses quick access to credit cards and an easy way to manage payments. The expense management also allows us to be more efficient by simplifying expense tracking.

The email receipts function is really convenient! I can just setup a macro to automatically forward receipts and then I don't have to worry about attaching them for electronic purchases. I haven't had any instances of a receipt failing to pair with an expense so far, and PayPal receipt emails work, so I could use that for many things if there's ever an issue. The split virtual and physical cards are also really convenient! It's also really minor, but I really like the aesthetic of Brex's websites and apps.

The app is a bit annoying because I have to log in every time I open it. I also have to set my notifications preferences for every login as well. It also sometimes takes me a bit to remember how to find specific pages on the website (it has a divider right above a new line on my laptop, so options are hidden). Other than that, though, it seems to work pretty well!

I primarily only make purchases and don't really worry about reconciling them, but the parts of Brex that I work with are really nice overall! It's really nice to be able to check expenses on my phone, and adding receipts is really convenient, as I mentioned before. As we start hiring more people, I'm sure that Brex's capabilities will be really convenient!

I love how easy it is to access my cards on the mobile app.

I haven't had any trouble with Brex so far.

Easy to use company card. Super easy to use online and with my Apple Wallet.

I like how I can assign people in my company a card and give it a limit. I really like how I can make new cards for different things. I like how I can review where the money is going.

The first time I tried Depositing a check, it couldn't read it. It didn't send me an email saying it was denied or anything. I had to call them to find out what had happened to my money. I waited two days only to find out I needed to submit it again then wait another two days. They say the problem is solved, but I haven't had time to submit a check then wait around two days.

I don't have to open up another bank account to give a team a card to work with. I can feel confident that my team has money on hand to get the job done, but I don't have to worry about them spending everything.

It's very intuitive and easy to navigate. I enjoy the different features of physical purchases and virtual purchases. It's straightforward to track and record all business expenses. Also, the design of the card and the application are very nice looking and the entire team agrees. Highly recommend this product for all of your team's expenses, purchases, and billing!

I sometimes get confused about which card number, either my physical or virtual card number, to use for purchases. For instance, online purchases need the virtual card number, which is counterintuitive to other cards where you pull out your physical card to buy something online. Online purchases require the virtual card number, while in-person purchases require the physical card, but you can also use your apple wallet card for in-person purchases. The apple wallet version of your brex card cannot be used for your online purchases. That is why I sometimes get confused!

I use this for my business expenses and purchases with the company I work for. I realize that it has been a great option and easy for my company to manage and track. You can upload receipts of your purchases if your company requires receipt uploads alongisde the Brex purchases. This feature ensures further validation and confirmation and helps upper management keep track of the entire team.

Brex is everything a startup needs. Fast and easy transfers, plus effortless card creation.

Their analytics are a bit limited. I think there might be a paid product (I received an email about a recent beta), but it would be nice if I could see spend broken down by category as a default.

We recieve and send funds through Brex. Easy to get a PDF of wire instructions for investment. We issue cards to employees with explicit limits and can turn on and off these cards as needed. It also integrates with Quickbooks.

Free wires, no fees, and ease of use. Better than any banking service we have tried.

I wish the credit card rewards were more generous.

We use Brex to pay vendors as well as connect to our Stripe account

Being able to categorize our expenses super easily

Most features work for card transactions but not for ACH transactions

With Brex now we have one centralized banking solution for all our payments (in and out)

I really like that Brex is very easy to use. When you setup a new employee, the onboarding for them is very easy, and you can easily control the spend on them. They also have great partners included that give you huge discounts too.

At times it has been difficult to setup an integration with Quickbooks, but it was fixed overtime. Some of the deals they show with partner companies don't actually exist too.

I want to make it very easy to give our employees the ability to spend if needed. The virtual card is great since if you lose your physical card, you do not need to change all of your subscriptions.

1) Easy to upload receipts -- can have it text you after retail expenses, and then just text back a photo of the receipt, can email receipts from your email and they auto-attach, can easily drag and drop when you're viewing the statement online. 2) Easy to add cardholders or create virtual cards and vendor-specific cards

Don't yet have a good expense reimbursement solution (we use Expensify, but it would be nice to switch everything to Brex)

Helps manage and track a lot of different spending in our startup, by enabling us to give separate cards to people with spending authority and having them attach receipts to all Brex expenses. We end up reimbursing a lot less and having a much clearer handle on spending categories

Ease of use for virtual cards, possibility to use with applepay.

Inability to deliver physical cards to certain countries.

It is a very solid service to handle expenses for our employees, expenses for the tech department in regular operation etc.

The bill makes it very easy to assign and manage expenses.

Nothing - it works like one would expect a 'new' finance tool to work.

It blends expense management/reporting directly into the financial tool. Rather than getting a bill from the cc company and trying to assign expenses/receipts, the process is integrated.